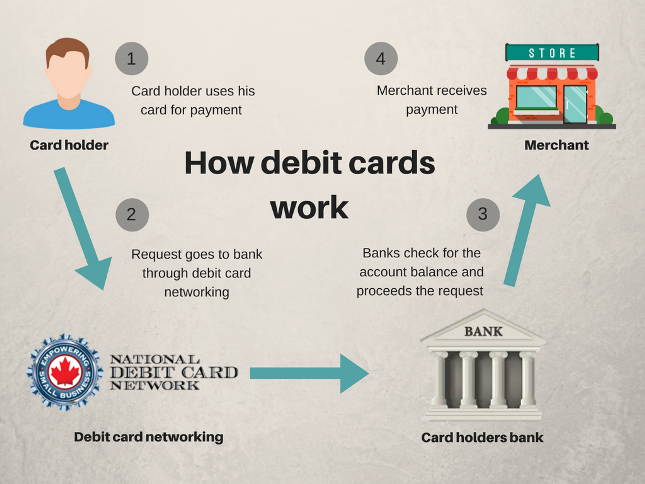

The bank then transfers the funds to the merchant’s bank and deducts the interchange fees.The issuing bank charges the cardholder’s debit or credit card for the transaction amount.The payment processor communicates with the card associations, which then communicate with the issuing banks, to pull the appropriate funds from the various financial institutions.Merchants batch their authorized transactions and send them to the payment processor.This takes place after the authorization process is complete. Next up is the settlement and funding process, which is how the merchant account receives the funds. For eCommerce transactions, debit or credit card information is entered into a virtual terminal–a web-based application that allows electronic payments to be processed–but the transaction processing steps are the same. This entire process may seem time-consuming but happens rather quickly at the point of sale, often in near real-time. Finally, the bank sends the status of the transaction back through the card association and merchant bank, and then to the merchant.The issuing bank then either approves or declines the transaction.

DEBIT CREDIT CARD PROCESSING CODE

The card-issuing bank verifies information such as billing address, security code and expiration date.The payment processor communicates with the appropriate card association (think Visa, MasterCard, Discover or American Express) to request payment authorization from the issuing bank.The merchant requests payment authorization from their chosen payment processor.Card information is either entered into the payment gateway online at checkout, or a card reader is used to swipe, insert the chip, or tapped to pay using contactless, near-field communication (NFC) technology.

Learn More Payment Processing Basicsīefore we explain the differences between credit and debit card processing in an online environment, we’ll first discuss the basics of payment processing for debit and credit cards, as they are very similar. In this article, we’ll explore the differences between credit and debit card processing, and what you need to know for online transactions. When the customer chooses their payment type, they understand where the funds will withdraw from, but don’t typically have in-depth knowledge of how each payment type is processed, particularly online. Credit cards are an entirely different type of account transactions do not withdraw funds from an actual bank account, instead, they count against the available credit limit. Debit cards are directly linked to a customer’s bank account and transactions pull funds directly from that account.

The differences between credit and debit cards are widely understood.

0 kommentar(er)

0 kommentar(er)